Some Ideas on San Diego Home Insurance You Need To Know

Some Ideas on San Diego Home Insurance You Need To Know

Blog Article

Secure Your Assurance With Reliable Home Insurance Plan

Why Home Insurance Is Necessary

The value of home insurance depends on its capacity to give economic protection and comfort to homeowners in the face of unanticipated occasions. Home insurance policy acts as a security net, supplying coverage for problems to the physical structure of your home, individual items, and liability for accidents that may occur on the home. In case of all-natural catastrophes such as fires, quakes, or floods, having a thorough home insurance coverage can help home owners recoup and reconstruct without facing significant financial burdens.

Furthermore, home insurance is frequently required by home mortgage lenders to protect their investment in the property. Lenders wish to make sure that their economic rate of interests are secured in case of any type of damage to the home. By having a home insurance coverage in place, homeowners can fulfill this need and safeguard their financial investment in the residential property.

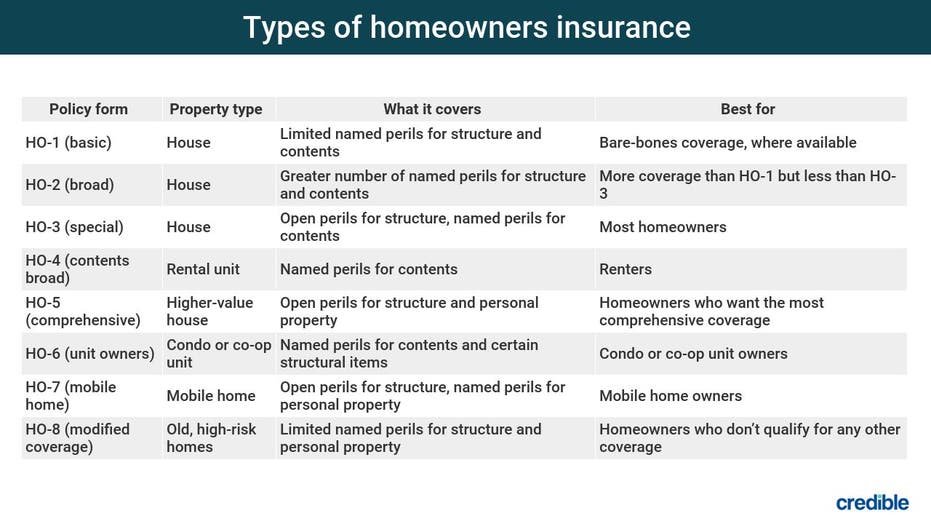

Kinds of Insurance Coverage Available

Provided the importance of home insurance coverage in shielding house owners from unexpected monetary losses, it is critical to understand the numerous sorts of protection offered to customize a plan that fits individual requirements and conditions. There are a number of essential kinds of protection supplied by most home insurance coverage. The initial is dwelling coverage, which shields the framework of the home itself from threats such as fire, criminal damage, and natural disasters (San Diego Home Insurance). Personal effects coverage, on the other hand, safeguards items within the home, including furniture, electronics, and clothes. If someone is injured on their building, responsibility protection is important for securing property owners from lawful and clinical costs. If the home comes to be uninhabitable due to a protected loss, extra living expenditures insurance coverage can assist cover prices. It is necessary for home owners to thoroughly evaluate and recognize the different types of protection available to guarantee they have sufficient defense for their particular needs.

Factors That Effect Premiums

Elements affecting home insurance policy costs can vary based on a variety of factors to consider particular to specific scenarios. One considerable element impacting costs is the area of the insured building. Homes in locations susceptible to all-natural calamities such as typhoons, earthquakes, or wildfires commonly attract greater costs because of the increased danger of damages. The age and condition of the home additionally play an important function. Older homes or buildings with out-of-date electric, pipes, or furnace might present higher threats for insurance provider, leading to greater costs.

In addition, the protection limitations and deductibles chosen by the insurance holder can affect the costs quantity. Opting for higher coverage limitations or reduced deductibles normally leads to higher costs. The type of building products used in the home, such as wood versus block, can also affect premiums as particular products may be much more at risk to damages.

How to Choose the Right Policy

Picking the suitable home insurance coverage policy includes cautious factor to consider of different crucial facets to guarantee thorough insurance coverage customized to private needs and situations. To begin, analyze the worth of your home and try these out its materials properly. Next off, consider the different kinds of protection readily available, such as home protection, individual home coverage, responsibility defense, and additional living expenses protection.

Moreover, reviewing the insurance policy company's reputation, monetary security, client service, and declares procedure is vital. Search for insurance providers with a history of trustworthy service and timely cases settlement. Ultimately, compare quotes from multiple insurers to discover a balance between cost and insurance coverage. By thoroughly examining these elements, you can choose a home insurance plan that offers the needed security and satisfaction.

Advantages of Reliable Home Insurance Policy

Trustworthy home insurance uses a sense of security and security for home owners versus unforeseen events and monetary losses. One of the essential advantages of reputable home insurance coverage is the assurance that your residential or commercial property will be covered in the occasion of damage or destruction caused by all-natural disasters such as fires, floods, or storms. This insurance coverage can help property owners avoid bearing the full expense of repairs or rebuilding, offering assurance and monetary security during difficult times.

In addition, trustworthy home insurance coverage commonly consist of liability defense, which can secure property owners from lawful and medical expenses in the instance of accidents on their home. This protection extends past the physical framework of the home to protect against legal actions and claims that might develop from injuries endured by visitors.

Additionally, having trustworthy home insurance can also contribute to a feeling of total well-being, recognizing that your most significant financial investment is guarded against numerous dangers. By paying normal premiums, homeowners can reduce the potential financial burden of unexpected events, permitting them to concentrate on appreciating their homes without continuous bother with what could take place.

Final Thought

In final thought, securing a reputable home insurance coverage is vital for safeguarding your residential or commercial property and possessions from unanticipated occasions. By comprehending the kinds of coverage readily available, variables that impact premiums, and exactly how to pick the appropriate policy, you can ensure your tranquility of mind. Counting on a reputable home insurance coverage company will provide you the benefits of monetary security and security for your most useful possession.

Navigating the realm of home insurance coverage can be complex, with different insurance coverage alternatives, plan factors, and considerations to evaluate. Understanding why home insurance coverage is vital, the kinds of protection available, and just how to select the appropriate plan can be crucial in ensuring your most significant investment remains protected.Given the significance of home insurance policy in shielding home owners from unexpected financial losses, it useful link is essential to understand the different types of insurance coverage readily available to customize a policy that fits specific demands and situations. San Diego Home Insurance. There are numerous key kinds of coverage supplied by the majority of why not try this out home insurance plans.Picking the proper home insurance coverage policy includes mindful factor to consider of different vital facets to make certain detailed coverage tailored to individual needs and circumstances

Report this page